All Categories

Featured

CRUCIAL: You ought to NOT repay the delinquent tax equilibrium during your purchase process (you will certainly probably have to accept a Quit Insurance Claim Deed as opposed to a Warranty Action for the building). Play the waiting game until the building has actually been foreclosed by the area and sold and the tax obligation sale.

Pursuing excess proceeds supplies some pros and disadvantages as a company. Think about these prior to you add this method to your actual estate investing arsenal.

There is the opportunity that you will earn absolutely nothing in the long run. You might lose not just your cash (which ideally won't be quite), yet you'll additionally shed your time as well (which, in my mind, is worth a lot more). Waiting to accumulate on tax sale overages calls for a great deal of resting, waiting, and wishing for results that typically have a 50/50 possibility (typically) of panning out favorably.

Accumulating excess proceeds isn't something you can do in all 50 states. If you've currently obtained a property that you wish to "chance" on with this approach, you 'd better wish it's not in the incorrect part of the country. I'll be honestI haven't spent a great deal of time meddling this location of investing since I can't manage the mind-numbingly slow speed and the total lack of control over the process.

If this seems like a business possibility you intend to study (or at the very least discover even more regarding), I know of one man who has actually produced a full-on program around this specific sort of system. His name is and he has actually discovered this world in excellent detail. I have actually been through a number of his programs in the past and have found his techniques to be extremely efficient and genuine money-making methods that work extremely well.

Tax Defaulted Property Sale

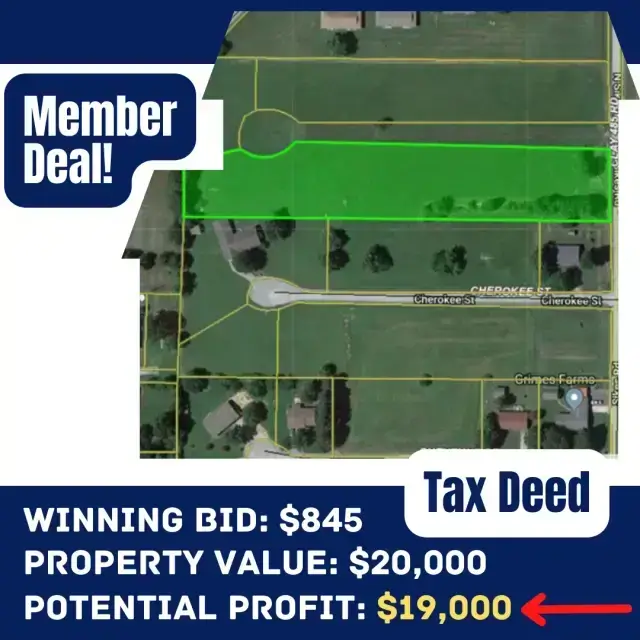

Tax obligation liens and tax actions typically offer for higher than the county's asking price at public auctions. Additionally, most states have legislations affecting proposals that exceed the opening quote. Repayments above the area's benchmark are called tax obligation sale excess and can be lucrative financial investments. Nevertheless, the details on overages can produce troubles if you aren't knowledgeable about them.

In this article we inform you just how to get checklists of tax obligation excess and make money on these properties. Tax sale excess, additionally referred to as excess funds or premium proposals, are the quantities proposal over the starting price at a tax obligation public auction. The term refers to the bucks the capitalist spends when bidding above the opening bid.

The $40,000 increase over the original bid is the tax obligation sale overage. Declaring tax sale overages indicates acquiring the excess cash paid during a public auction.

That stated, tax sale overage claims have actually shared attributes throughout many states. During this duration, previous owners and home mortgage holders can get in touch with the area and receive the overage.

If the period expires prior to any kind of interested parties claim the tax sale excess, the region or state typically takes in the funds. Once the money mosts likely to the government, the opportunity of declaring it vanishes. Therefore, previous owners get on a strict timeline to claim overages on their residential properties. While excess typically don't relate to higher earnings, financiers can take benefit of them in numerous ways.

Tax Lien Property Listing

, you'll earn interest on your entire proposal. While this aspect does not mean you can declare the excess, it does aid alleviate your expenditures when you bid high.

Remember, it may not be lawful in your state, indicating you're limited to collecting interest on the overage. As specified above, a capitalist can locate means to benefit from tax obligation sale overages. Because rate of interest earnings can apply to your whole bid and previous proprietors can declare overages, you can leverage your understanding and tools in these situations to maximize returns.

Initially, as with any type of financial investment, research is the essential opening action. Your due persistance will certainly supply the required understanding into the residential properties available at the next auction. Whether you use Tax Sale Resources for investment information or contact your area for details, an extensive assessment of each building lets you see which properties fit your investment design. A critical aspect to bear in mind with tax obligation sale excess is that in the majority of states, you only need to pay the area 20% of your complete proposal up front. Some states, such as Maryland, have regulations that exceed this guideline, so once again, research your state legislations. That claimed, most states follow the 20% regulation.

Rather, you only require 20% of the quote. If the residential property does not retrieve at the end of the redemption period, you'll require the continuing to be 80% to acquire the tax obligation action. Since you pay 20% of your proposal, you can earn interest on an overage without paying the full cost.

Again, if it's lawful in your state and county, you can work with them to help them recuperate overage funds for an extra charge. So, you can collect interest on an overage quote and charge a fee to simplify the overage case procedure for the past proprietor. Tax Sale Resources just recently launched a tax obligation sale overages item specifically for people thinking about seeking the overage collection organization. otc tax lien states.

Overage collection agencies can filter by state, area, building type, minimal overage quantity, and optimum excess quantity. As soon as the information has been filteringed system the enthusiasts can determine if they intend to include the avoid mapped data plan to their leads, and afterwards spend for only the validated leads that were found.

Defaulted Property

In enhancement, just like any kind of various other investment method, it provides unique pros and cons.

Tax sale overages can create the basis of your financial investment version due to the fact that they supply an economical means to make cash (foreclosure tax). You do not have to bid on properties at public auction to spend in tax sale overages.

Rather, your study, which may entail avoid mapping, would cost a somewhat little fee.

Your sources and method will identify the best atmosphere for tax obligation overage investing. That said, one method to take is collecting interest on high costs.

Furthermore, overages put on greater than tax acts. Any auction or repossession involving excess funds is an investment chance. On the other hand, the major downside is that you may not be compensated for your difficult work. For example, you can spend hours looking into the previous proprietor of a home with excess funds and call them only to discover that they aren't thinking about going after the cash.

Latest Posts

Property Back Taxes Owed

2020 Delinquent Tax List

Tax Owed Homes For Sale