All Categories

Featured

Table of Contents

, providing them with the capital needed to grow., you receive your passion settlements plus the principal at the end of the 2 year term.

Due to the fact that this kind of financial investment is generally not available to the public, realty can offer recognized capitalists special chances to diversify their portfolios. Nevertheless, realty investments can also include disadvantages. Deals usually need substantial resources and lasting dedications as a result of high up front high capital investment like purchase prices, maintenance, tax obligations, and charges.

Some investments are just open to recognized capitalists. Which ones will align with your goals and take the chance of tolerance? Review on to figure out. Below are the top 7 approved financier opportunities: Special accessibility to exclusive market financial investments Wide variety of alternate investments like art, realty, legal funding, and much more Goal-based investing for growth or revenue Minimums beginning from $10,000 Invest in pre-IPO firms with an EquityZen fund.

Investments include danger; Equitybee Securities, member FINRA Accredited investors are one of the most competent capitalists in the service. To certify, you'll need to fulfill one or more needs in revenue, total assets, property size, administration condition, or professional experience. As an approved capitalist, you have access to much more intricate and advanced sorts of safeties.

What is Accredited Investor Commercial Real Estate Deals?

Enjoy accessibility to these alternate financial investment opportunities as an approved financier. Certified financiers typically have a revenue of over $200,000 independently or $300,000 collectively with a partner in each of the last two years.

To gain, you just need to register, invest in a note offering, and wait on its maturity. It's a terrific resource of easy revenue as you do not require to monitor it very closely and it has a brief holding period. Good yearly returns vary between 15% and 24% for this asset class.

Possible for high returnsShort holding period Funding in jeopardy if the debtor defaults AssetsContemporary ArtMinimum Financial investment$15,000 Target Holding Period3-10 Years Masterworks is a system that securitizes excellent artworks for investments. It acquires an artwork through public auction, then it registers that asset as an LLC. Beginning at $15,000, you can purchase this low-risk asset course.

Buy when it's used, and afterwards you get pro-rated gains when Masterworks sells the artwork. The target period is 3-10 years, when the art work gets to the desired value, it can be offered previously. On its site, the very best appreciation of an artwork was a massive 788.9%, and it was just held for 29 days.

Its minimum begins at $10,000. Yieldstreet has the widest offering throughout alternative investment platforms, so the quantity you can gain and its holding period differ. Real Estate Investment Partnerships for Accredited Investors. There are items that you can hold for as short as 3 months and as lengthy as 5 years. Typically, you can gain through rewards and share gratitude over time.

Why are Real Estate Syndication For Accredited Investors opportunities important?

One of the downsides below is the lower yearly return rate contrasted to specialized platforms. Its administration cost typically varies from 1% - 4% annually.

As a capitalist, you can gain in 2 means: Obtain dividends or money yield every December from the rent paid by renter farmers. Gain pro-rated revenue from the sale of the farmland at the end of the holding period.

How can Accredited Investor Rental Property Investments diversify my portfolio?

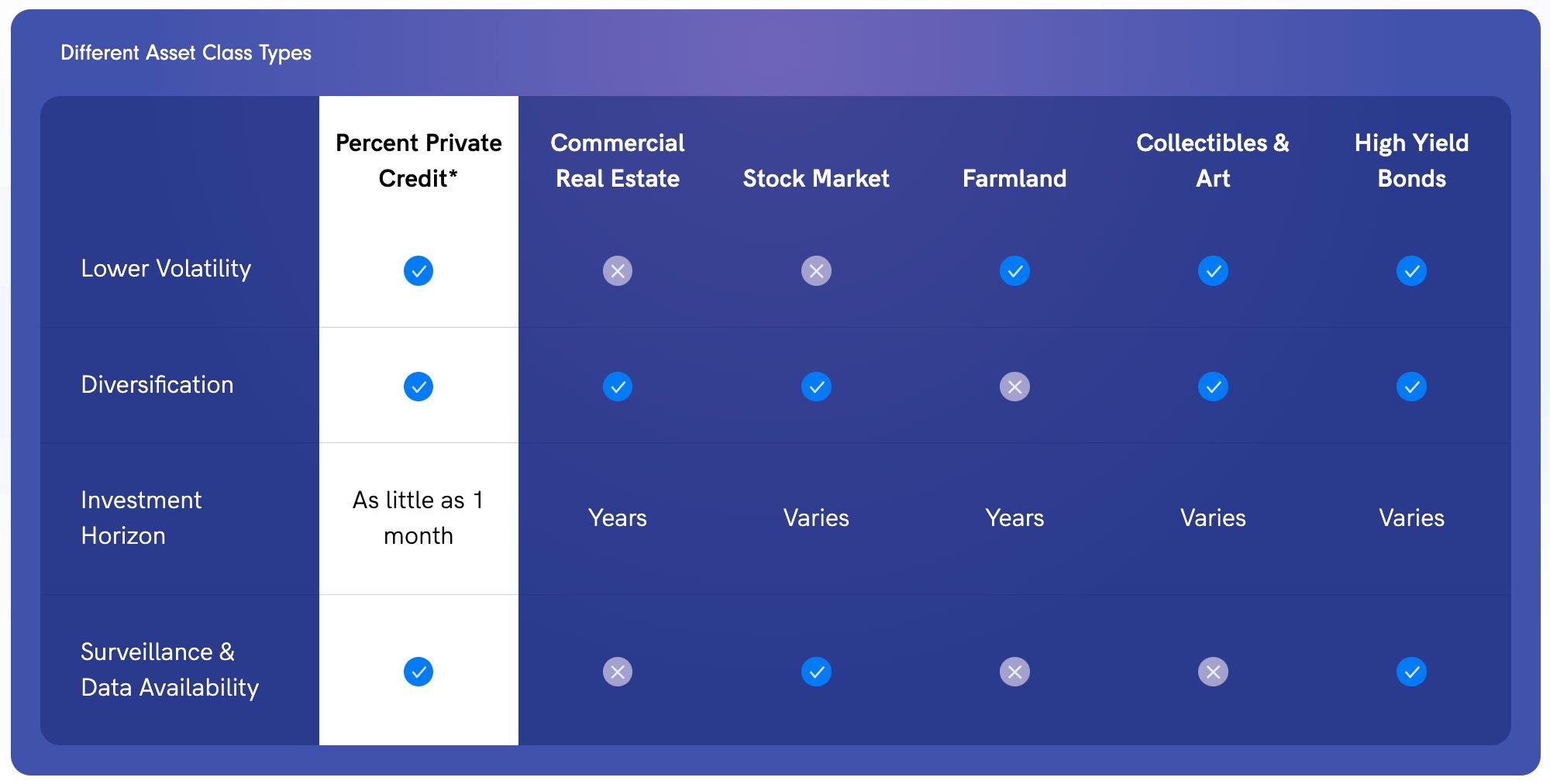

Farmland as an asset has historically low volatility, which makes this an excellent option for risk-averse investors. That being claimed, all investments still carry a specific degree of danger.

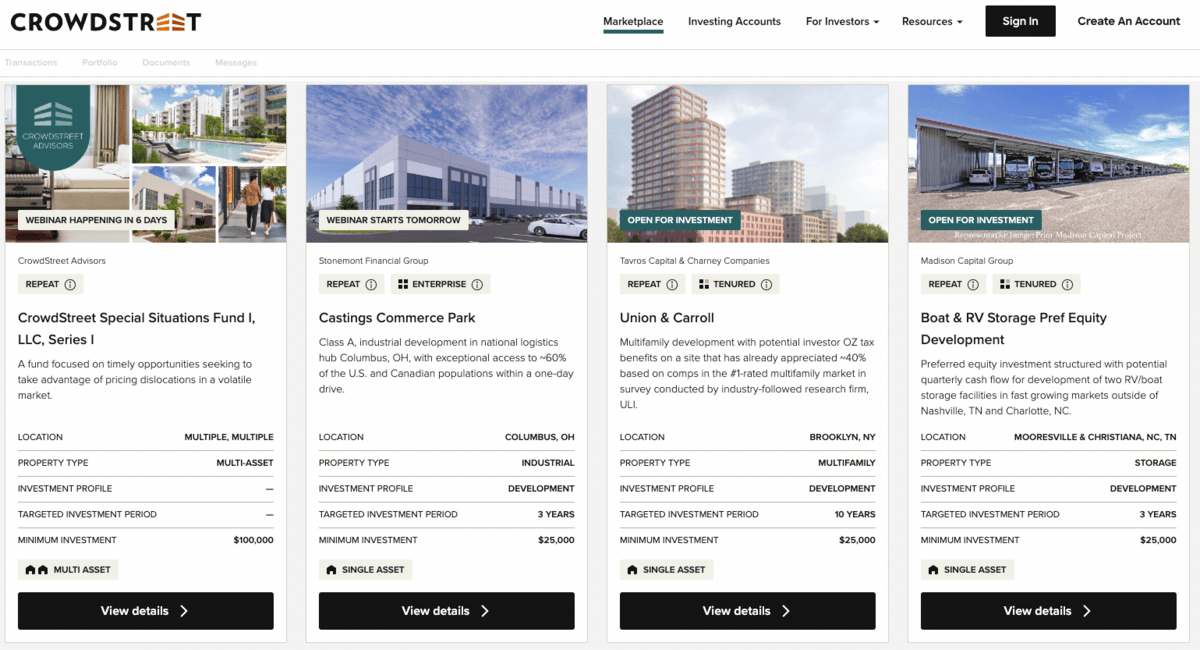

Furthermore, there's a 5% fee upon the sale of the entire home. It invests in various offers such as multifamily, self-storage, and commercial residential properties.

Managed fund by CrowdStreet Advisors, which instantly diversifies your investment across numerous properties. When you buy a CrowdStreet offering, you can receive both a cash money return and pro-rated gains at the end of the holding duration. The minimal financial investment can differ, yet it typically starts at $25,000 for market offerings and C-REIT.

How do I exit my Accredited Investor Real Estate Income Opportunities investment?

Genuine estate can be commonly reduced danger, but returns are not ensured. In the history of CrowdStreet, even more than 10 properties have negative 100% returns.

While you won't obtain possession below, you can possibly obtain a share of the revenue once the startup successfully does an exit event, like an IPO or M&A. Several great companies continue to be personal and, for that reason, often inaccessible to investors. At Equitybee, you can money the stock choices of staff members at Stripe, Reddit, and Starlink.

The minimal financial investment is $10,000. This platform can potentially provide you big returns, you can likewise lose your whole cash if the startup fails.

What should I know before investing in Exclusive Real Estate Crowdfunding Platforms For Accredited Investors?

When it's time to exercise the choice during an IPO or M&A, they can profit from the potential increase of the share price by having a contract that allows them to get it at a price cut. Accessibility Numerous Start-ups at Past Valuations Diversify Your Profile with High Development Startups Invest in a Formerly Inaccessible Possession Class Subject to accessibility

Alpine Note is a short-term note that offers you relatively high returns in a brief period. It can either be 3, 6, or 9 months long and has a set APY of 6% to 7.4%. It likewise uses the Climb Revenue Fund, which purchases CRE-related senior financial obligation loans. Historically, this revenue fund has actually outmatched the Yieldstreet Choice Revenue Fund (previously referred to as Yieldstreet Prism Fund) and PIMCO Income Fund.

Other features you can purchase consist of buying and holding shares of commercial areas such as industrial and multifamily residential or commercial properties. Nevertheless, some individuals have whined concerning their absence of openness. Evidently, EquityMultiple doesn't interact losses quickly. Plus, they no much longer publish the historical performance of each fund. Short-term note with high returns Absence of transparency Complicated costs framework You can qualify as an approved financier utilizing two requirements: economic and specialist capacities.

Table of Contents

Latest Posts

Property Back Taxes Owed

2020 Delinquent Tax List

Tax Owed Homes For Sale

More

Latest Posts

Property Back Taxes Owed

2020 Delinquent Tax List

Tax Owed Homes For Sale